General

Summary of TREB MLS® Sales for the GTA and Average Price October 1 to October 31, 2020

Posted by: Croydon DeMello

Summary of TREB MLS® Sales for the GTA and Average Price September 1 to September 30, 2020

Posted by: Croydon DeMello

Summary of TREB MLS® Sales for the GTA and Average Price August 1 to August 31, 2020

Posted by: Croydon DeMello

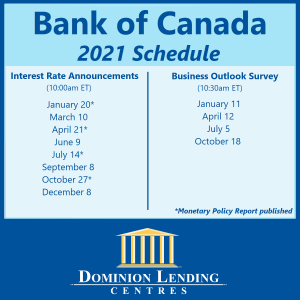

Bank Of Canada Policy Interest Rate Announcement October 28, 2020

Posted by: Croydon DeMello

‘The Bank of Canada today maintained its target for the overnight rate at the effective lower bound of ¼ percent, with the Bank Rate at ½ percent and the deposit rate at ¼ percent.’ – Bank Of Canada

Bank Of Canada Policy Interest Rate Announcement September 9, 2020

Posted by: Croydon DeMello

The Bank of Canada today maintained its target for the overnight rate at the effective lower bound of ¼ percent. The Bank Rate is correspondingly ½ percent and the deposit rate is ¼ percent.

Summary of TREB MLS® Sales for the GTA and Average Price July 1 to July 31, 2020

Posted by: Croydon DeMello

Sales 11,081

Average Price $943,710

New Listings 17,956

Bank Of Canada Policy Interest Rate Announcement July 15, 2020

Posted by: Croydon DeMello

The Bank of Canada today maintained its target for the overnight rate at the effective lower bound of ¼ percent. The Bank Rate is correspondingly ½ percent and the deposit rate is ¼ percent.

Summary of TREB MLS® Sales for the GTA and Average Price June 1 to June 30, 2020

Posted by: Croydon DeMello

Sales 8,701

Average Price $930,869

New Listings 16,153